Everything That You Need To Know About 2D Payment Gateways

By Storeplum Editorial

Posted | 3 min read

A payment gateway is a technology used by merchants to accept debit or credit card or another form of purchases from customers.

The term was coined in the early 90s before the boom of the Internet bubble. According to a report published by Statista, the global market size of digital payments is 8.48 trillion USD as of 2022.

That is a massive number. It also means that payment gateways are going to get more sophisticated in the near future then they are already.

This article explains the basics of payment gateways, different variations and their pros and cons. Let's dive in.

How does a payment gateway work?

To put it in simpler terms, a payment gateway enables a merchant to accept payments from their customers directly over the Internet through a simple interface.

Point of sale terminals, QR codes and Near Field Communication (NFC) terminals are used as an interface to accept payments in a brick and mortar store.

On the other hand, e-commerce websites use a standard checkout option from the payment gateway provider as an interface for users to enter their payment information.

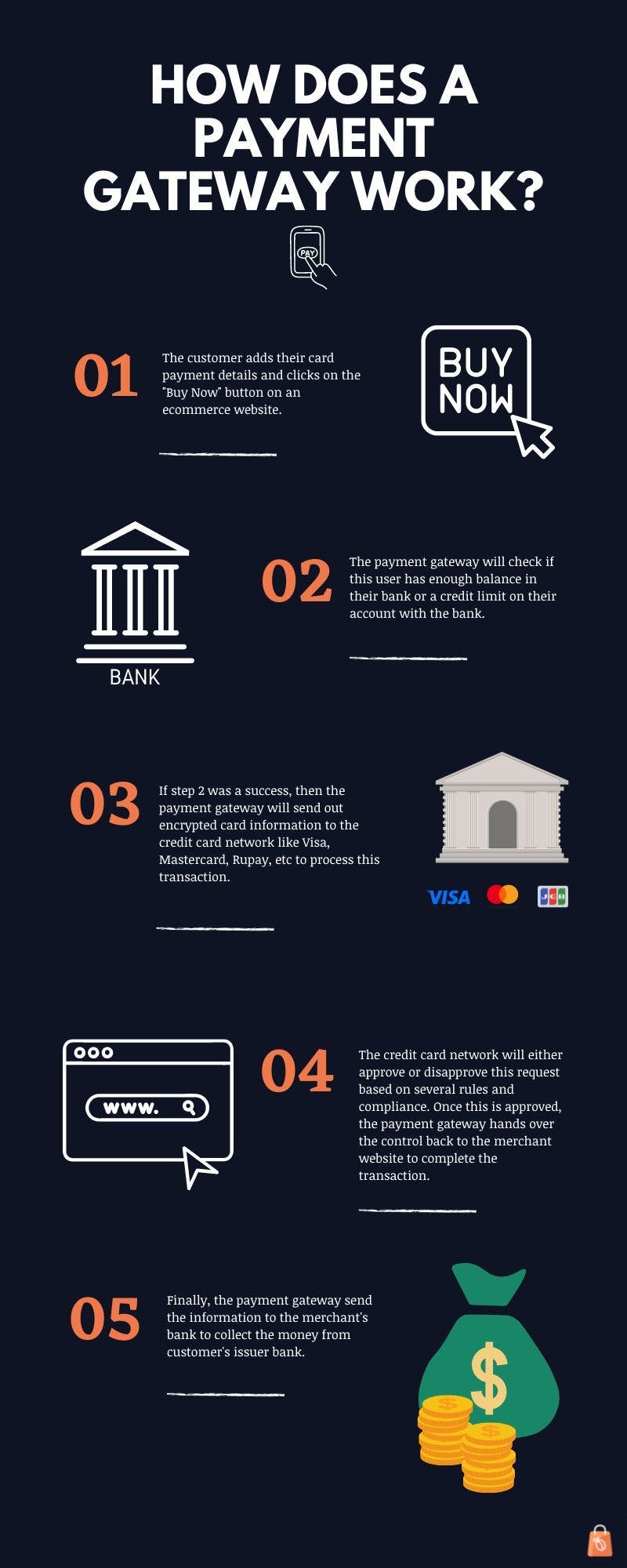

A typical payment gateway performs the following steps when someone is making a purchase online.

| Step | Action |

|---|---|

| Step 1 | The customer adds their card payment details and clicks on the "Buy Now" button on an ecommerce website. |

| Step 2 | The payment gateway will check if this user has enough balance in their bank or a credit limit on their account with the bank. If this fails, then the transaction is cancelled and the customer is asked to try with a different card or other means of payment. |

| Step 3 | If step 2 was a success, then the payment gateway will send out encrypted card information to the credit card network like Visa, Mastercard, Rupay, etc to process this transaction. |

| Step 4 | The credit card network will either approve or disapprove this request based on several rules and compliance. Once this is approved, the payment gateway hands over the control back to the merchant website to complete the transaction. |

| Step 5 | Finally, the payment gateway sends the information to the merchant's bank to collect the money from the customer's issuer bank. |

As you might have guessed, since there's real money involved, the entire transaction happens over a secure sockets layer, commonly known as SSL in computer science lingo. It is the reason why almost all of the online websites are now HTTPS enabled by default.

What is a 2D secure payment gateway?

Now that you have a high level overview of how a payment gateway works, let's understand what a 2D payment gateway is and why it is important.

Security is an integral part of online payments processing. Without any right secure protocols in place, every online transaction on the Internet will be exposed to cyber attacks, fraudulent charges and identity thefts.

For these reasons, payment gateways have to adhere to compliances imposed by financial institutions and from governments all over the world.

A 2 Dimension Secure, commonly known as a 2D secure payment gateway is a simple authentication system implemented by a majority of global payment gateways.

To put it in simpler terms, a 2D secure payment gateway safeguards user information across the entire payment transaction from customer's issuer bank to merchant's bank.

Using 2D payment gateway

A 2 dimension secure card authentication involves asking for user information which is present on their card. Eg. User first name, last name, card number, card expiry date and 3 digit CVV number.

Since this information is accessible by the card owner, the gateway authorises this information and proceeds ahead with the transaction without any further authentication.

A major drawback with this approach is the misuse of information when a card is stolen, lost or if someone got access to this information without the card holder knowing about it. Many payment gateways are 2D secure including Paypal, Stripe, Braintree and others.

2D payment gateways are still widely popular even with this major drawback in their security. This is because of the convenience that it comes with. Users are not bombarded with additional security questions or one time passwords to authenticate themselves while completing a payment transaction.

Research has shown that any minor distraction while shopping online leads to an increase in cart abandonment by over 12%. For these reasons, a 2D payment gateway is still supported by the majority of merchants all over the world.

The United States, Canada and most of the countries in Europe have shown a wide acceptance to 2D payment gateways. Most of the issuing banks in these countries manage fraudulent charges, charge back and related issues directly instead of involving payment processors directly in the transaction.

In some countries like India, the government has made it mandatory for payment gateways to carry out an additional authentication mechanism using one time passwords sent on either email or mobile phone in order to make an online purchase.

This strong customer authentication provides additional security while carrying out an online payment transaction. A security check like this makes a payment gateway 3-D secure, popularly known as 3D payment gateway.

Difference between 2D and 3D payment gateways

| 2D Payment Gateway | 3D Payment Gateway |

|---|---|

| Online payments are completed just using credit card number and CVV | Online transactions are completed with an additional verification of the card owner using one time password. |

| Less secure due to inherent fear of risks like stolen card or loss of card. | More secure as stolen cards won't be of any help without one time password verification. |

| Less acceptance for international transactions. | Can accept international currencies by default. |

| Merchants have to go through additional paperwork and documentation in order to support international payments. | Integration of a 3d secure payment gateway is exactly same as that of a 2d payment gateway. |

| Integration of a 2D payment gateway is no different than integrating a 3d secure payment gateway. | Service providers or merchants are at a lower risk of fraudulent charges. |

| Merchant accounts are at higher risk of facing fraudulent charges using stolen credit/debit cards. | 3d secure technology adds an additional verification step, leading to a less user friendly shopping cart experience. |

| Overall online shopping experience is quick and easy for merchant's customers. | Overall online shopping experience is slightly hampered due to an additional step of verifying user identity. |

1. What is a 2D payment gateway?

A 2D payment gateway is a type of payment gateway which allows users to make an online purchase using their credit/debit card details like name, number and CVV without any need of additional authentication like one time password or OTP.

2. Is stripe a 2D payment gateway?

Stripe supports 2D as well as 3D secure 2 card authentications. The default Stripe integration runs on a 3D secure 2. If the customer's bank doesn't support it, it falls back to 3D secure 1.

3. What is a 3D payment gateway?

A 3D secure payment gateway is a type of card authentication mechanism which allows customers to pay online using their card details along with a one time password sent on their email or mobile phone.

4. Is 3D Secure mandatory?

3D secure payment option is soon going to be mandatory for all payment gateways as it adds an additional layer of security and mitigates the risk of chargebacks and fraudulent charges for merchants.

5. What is a high risk payment gateway?

High risk payment gateways allow customers to pass their credit card details to the business and the financial institution without any need of additional authentication mechanisms.

6. What is a high risk merchant?

A merchant is labelled as a high risk business when there is a high risk of fraud or chargebacks based on the business as evaluated by the payment processors.

Storeplum's in-house editorial team brings to you the best content when it comes to growing your online business on the Internet. We write about growth hacks, case studies, government schemes and other related information for e-commerce business.